Payments and fraud control are adjacent in the digital ecosystem. And now, with an exciting new partnership, so are Spreedly and Forter. Merchants can now take advantage of Forter’s Trust Platform and reporting directly from within Spreedly’s platform.

When left unchecked, fraud can become costly to manage and quickly erode a merchant’s profits and reputation. Based on both Forter and Spreedly’s data:

-

- Online retailers lost $6T to fraud in 2021 (Beyond eCommerce Fraud PYMNTS Report, 2021)

- Spreedly tracked a 44% increase in fraud transactions in 2022 (Based on Spreedly’s first-party data)

- 46% of merchants said that reducing fraud and chargebacks is the most important priority in a fraud management strategy (MRC Global Fraud & Payments Report, 2022)

With a strong and growing base of mutual customers, and a shared mission of offering robust, low-impact services to merchants, this exciting new partnership allows Forter to implement fraud solutions within Spreedly’s platform — bringing the solutions to Spreedly’s customer base.

Integrating with Spreedly

Spreedly’s orchestration layer is constantly evolving to create greater efficiency, control, and revenue across its clients’ payments stack. While fraud layers can be developed in-house, they are costly to build and maintain. Forter offers enterprise-grade services that bridge that gap between cost and performance and brings the added benefit of a network effect: the cost of the solution is spread across a provider’s entire portfolio, putting costs well under our estimates for building and maintaining a bespoke product.

Customers of Spreedly also gain the benefit of insights across Forter’s fraud prevention network. High-risk activity can be detected across the landscape, and the solution can learn and adapt before threats spread to other areas.

The benefits of a diverse payments ecosystem with Spreedly are myriad. Clients like Zebrands have seen radical shifts in areas like authorization rates from reducing false-positive declines. Fraud control is a pillar of this and is a particular bulwark for merchants serving new markets, verticals, and geographies. When combining diversifying payment methods, a multi-gateway infrastructure, and card-lifecycle management, the benefits to clients grow exponentially. Based on Forter’s first-party data, merchants that switch to Forter reduce chargebacks by up to 72% and decrease false declines by up to 46%.

“Spreedly is excited to partner with Forter to provide merchants with a complete payment and fraud prevention solution. By combining our payment orchestration platform with Forter’s leading fraud prevention technology, we can help merchants improve their payment processing and reduce the risk of fraud.” — Justin Benson, CEO, Spreedly

Fraudsters should be thought of as dynamic businesses. They adapt to new market environments, changing technology or behavior, and in response to existing controls.

This reality drives Spreedly’s commitment to offering best-in-class fraud services within its orchestration layer. The importance of adaptive, tech-forward fraud prevention is self-evident today. Forter is proud to partner with Spreedly to better position merchants in the fight against fraud within its products.

“For 46% of merchants, reducing fraud and chargebacks is the most important priority in a fraud management strategy. We’re thrilled to welcome Spreedly to our Forter Partner Program as we continue to drive meaningful business impact across payment optimization, fraud prevention and customer experience.” — Ryan Quaye, VP Global Growth and Ecosystems, Forter

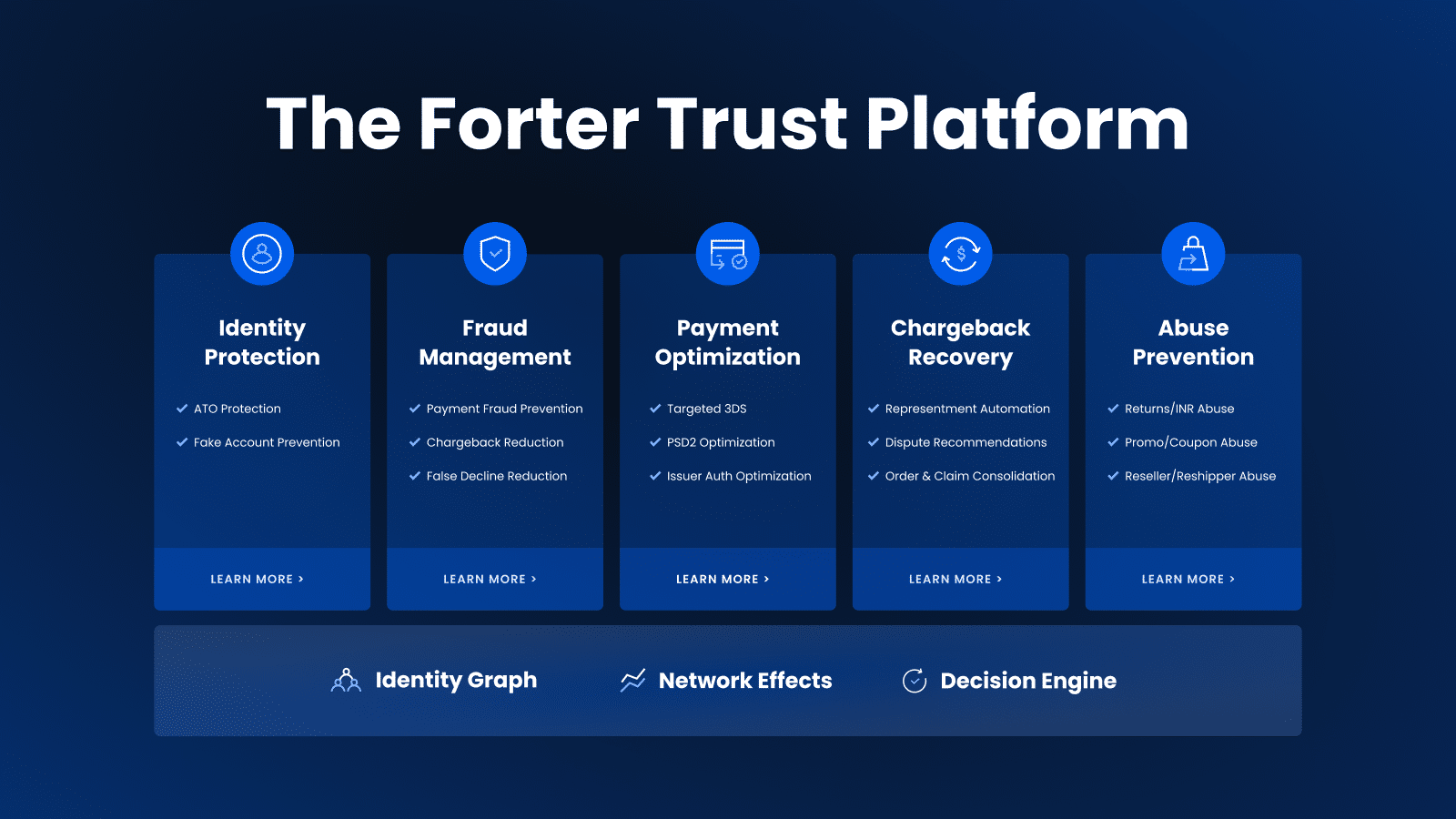

About Forter

Forter is the Trust Platform for digital commerce. We make accurate, instant assessments of trustworthiness across every step of the buying journey. Our ability to isolate fraud and protect consumers is why Nordstrom, Instacart, Adobe, Priceline, and other leaders across industries have trusted us to process more than $500 billion in transactions. Click here to learn more.