Retailers are so busy combating the threat of fraud on a day-to-day level – preventing fraudulent transactions from making it through the system, avoiding false positives, worrying about the impact on customer experience and sales, and so on – that it’s often hard to find the time to take a step back and assess the current state of fraud on a larger scale.

Yet the insights you gain from a broader perspective are considerable. Keeping track of where fraud attacks are coming from, and what kind of attacks are coming from which geographical areas, can be enormously helpful in identifying and blocking those kinds of attacks.

Similarly, it can be valuable to know how your industry compares to others, and understand how verticals vary with regard to the amount of fraud attacks and the most common types. Seeing how such trends develop over time can also be useful in understanding what’s going on in the world of fraud – and what you should do to protect your company in the future.

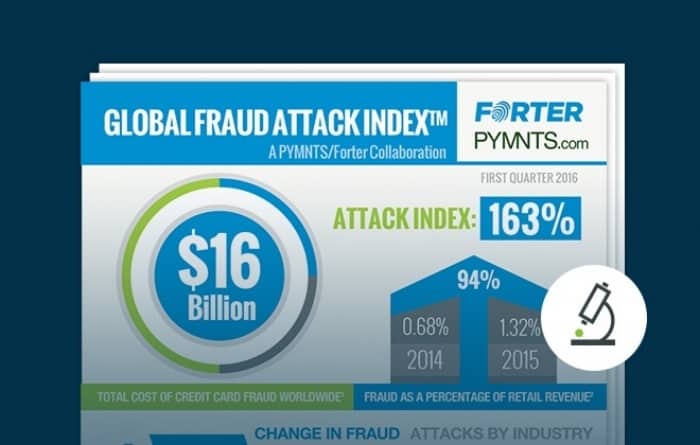

Enter the Global Fraud Attack Index™, a PYMNTS/Forter collaboration.

The Global Fraud Attack Index™ is designed to provide retailers with precisely this kind of knowledge, so that businesses can plan ahead based on solid information.

The idea behind the Index was to provide retailers with a 360 degree view of what’s going on in online fraud – considering variables from vertical to geography to fraudster techniques – and what it all means.

The Index will come out a number of times a year, enabling online merchants to keep track of what’s changing and what’s consistent when it comes to online fraud, so that they can alter their own approach accordingly.

Highlights of the First Quarter 2016 Global Fraud Attack Index™

The news isn’t precisely comforting, as we look back over how online fraud trends changed from Q1 2015 to Q3 2015. Most notably:

- Online retail fraud attempts grew 163% Q1-Q3 2015.

- Digital goods fraud attempts grew 254%.

- Fraud attempts on the Luxury segment have more than doubled.

- And botnets account for 82% of fraud attempts coming out of the USA.

The increase in online fraud attempts isn’t unexpected, the result of a combination of factors including the U.S. adoption of EMV, the growth of online commerce, the wealth of stolen data easily available to criminals online as a result of a continuing slew of data breaches, and so on. It is certainly worth watching, however – a sign that 2016 is a year when e-commerce merchants should take online fraud and its prevention very seriously indeed.

Digital and Luxury Goods Fraud

The growth of digital fraud attempts and luxury fraud attempts are logical too. Fraudsters are drawn to both verticals for good reasons.

Digital goods are, in a sense, a dream come true for online criminals – buying them requires less information than physical goods (there’s no shipping address, just to start with) and instant fulfillment speeds up, and removes much of the difficulty from, monetizing the attack.

Luxury goods are also attractive, though for a different reason. Luxury goods are valuable and relatively easy to resell. It may take longer and involve more complexity than digital goods, since something physical is involved, but the potential pay-off is considerable – well worth the time the fraudster invests. This is probably the reason that luxury goods represents the only vertical where the average attack amount has increased.

Botnets and Sophisticated Fraud

Botnets are an interesting example of how fraud technique varies by location. Botnets, it turns out, are hugely popular with fraudsters who are based in the U.S. The only good news here is that the average attack amount for botnets is decreasing, bringing down the overall average amount.

Something to watch – sophisticated fraud is also growing, particularly in the luxury and digital goods sectors. This makes sense if you pair it with the increasing popularity of fraud in those verticals; the same factors that make them popular in the first place mean that it’s worth putting a bit of extra work into making the fraudulent attempts successful.

The Good News

What retailers should remember, if this news seems like doom and gloom, is that these numbers reflect fraud attempts, not successful fraud attacks. The Index looks at what’s current in the world of fraud, and what’s trending in the fraudster ecosystem – the latest online fraud trends. It’s not focused solely on what’s working for fraudsters.

Fortunately for retailers, the latest fraud prevention systems are a step ahead of the online criminals.

Fraudsters might use botnets against you, but antifraud can be totally automated nowadays, too, meaning that merchants are protected in real-time by systems that are sensitive to developing trends and norms in both fraudulent and genuine buyers.

Keep It In Perspective

As always, it’s important not to focus so much on stopping fraud that you let your antifraud methods get in the way of a good customer experience. Your legitimate customers shouldn’t suffer because you’re concentrating on the fraudulent ones.

With the latest fraud technology, combining big data, machine learning and human expertise, retailers do not have to compromise between fraud prevention and customer experience. With real-time, fully automated fraud prevention, it is possible to prioritize both.