Merchants and issuing banks haven’t always seen eye to eye regarding online payments. Some of that is due to differences in priorities and incentives, but much of it simply comes down to a lack of communication. Unfortunately, this has a measurable impact on merchants’ and issuers’ bottom lines because miscommunication leads to lost revenue and poor customer experience.

The good news is that it’s becoming easier than ever to fix both the communication gap and the problems it causes, to increase conversions and improve customer experience.

Banks Want Different Things

From a merchant perspective, it’s easy to assume that issuing banks all want more or less the same things. In many ways, especially regarding how the global payments infrastructure is set up, that’s true. But there are certain areas where banks have very different approaches, and these areas directly impact merchants’ bottom lines.

Let’s take 3DS as an example because this is an area where it’s possible to measure the gap between different banks.

Many merchants assume that all banks react to 3DS in the same way. Therefore, which specific issuing bank is involved in a given transaction plays no part in a merchant’s decision about whether to use 3DS for that transaction.

Banks have widely differing views on 3DS:

- Some banks consider the use of 3DS to be a strong sign of legitimacy in a transaction because 3DS provides a powerful authentication signal.

- Some banks are precisely the opposite; they assume that a merchant only uses 3DS for a transaction if something suspicious exists.

- Other banks resent 3DS on principle because successful 3DS means that the bank shoulders the liability if a chargeback should result.

- Still, other banks take a nuanced approach to 3DS, in which how they view its use will depend on the transaction details. Some strongly prefer cases where frictionless 3DS is possible, for example.

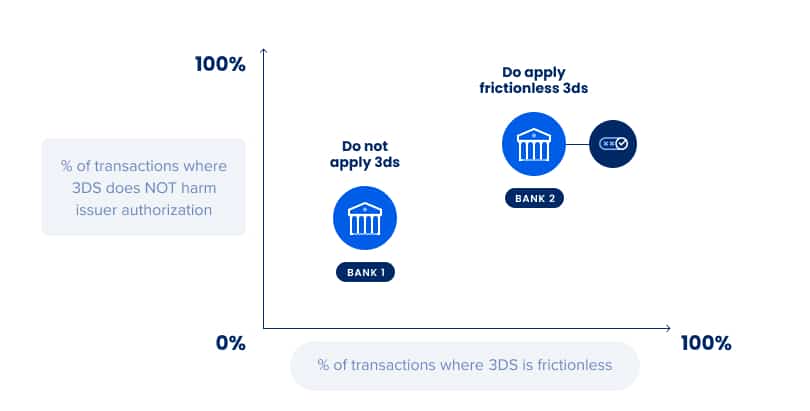

Look at this graph to see real anonymized examples of the huge difference between how two banks approach 3DS:

Merchants often don’t appreciate that the bank’s approach to 3DS influences how likely the bank is to authorize the transaction. 3DS authentication happens before the bank decides whether or not to authorize the transaction and is a separate process, often including a third-party vendor. It’s perfectly possible for the 3DS authentication to go smoothly and for the bank to then decide to decline the transaction because they don’t want to take on the liability shift. In fact, this is sometimes exactly what happens.

While this might feel unfair, it’s down to the merchant to determine which banks want which kind of approach and to tailor each transaction accordingly. This is complicated because, even within a single bank, there may be different platforms with different policies influencing different decisions. For instance, credit and debit portfolios may have very different behaviors despite being part of the same bank.

In the same way, with chargeback representment, different banks prefer to see different sorts of evidence presented in different ways and orders. It’s up to merchants to ensure their evidence is tailored to the bank’s preferences to ensure the highest possible chances of a successful dispute resolution.

Merchants can invest time, research and resources into working out different banks’ preferences directly, and there is evidence to show that very large merchants, in particular, have had success with this approach. It’s also possible to leverage a trusted third-party provider with the knowledge and relationships with banks to speed up and shorten the process.

Banks Keep Having to Guess

Merchants are not always aware that part of the bank authorization decision is a fraud decision. Around 1-in-5 bank declines are due to suspected fraud. Of that 20%, 2-in-5 bank fraud declines are legitimate customers. If you’re a merchant, and you’re thinking about what that means in terms of conversion rate, a considerable number of transactions are lost for entirely preventable reasons.

To illustrate the impact on your bottom line, for every $100M in bank declines, $8M of those are false declines. Consider the customer experience, as well; there’s no worse experience than a false decline, with its knock-on effect further down the road in terms of loss of loyalty and reduced likelihood of a returning customer.

Why is the bank’s decline rate so high? Because banks keep on having to guess. If you consider the vast amount of data that merchant fraud teams have at their disposal, including every aspect of customer behavior on the site, device and browser fingerprinting, data enriched by third-party providers, and so on — and then compare that to the bare bones of the transaction data that the bank receives from the merchant, you’ll see where the problem lies.

Once again, the issue is one of communication. If merchants can share more of their insights, trust in the customer, and data with the bank, then the bank can build trust in the merchant’s fraud assessment and increase their authorization rate.

Merchants can do this slowly over time, alongside relationship building with each bank, or piggyback off the existing relationships and trust that some providers have with banks already. Forter, which already has these trusted relationships in many cases, saw one recent case where a merchant’s overall conversion rate went up a full 1% simply because banks were willing to trust Forter’s fraud assessment of the transactions they received. This is an excellent example of how impactful it can be when merchants stop leaving that money on the table.

The point is that once a bank understands that they can trust a merchant to send reliably legitimate transactions and/or see more of the data that went into the decision, they no longer need to engage in guesswork. They can approve confidently, instead.

Banks Want Enriched Communication

Historically, there was a lack of interest in building bridges that enabled improved communication and trust between merchants and issuing banks. That’s no longer the case. Banks are actively trying to encourage network engagement.

Banks want deepened communication with their merchants, more informative payloads, and transactions and data tailored to their requirements — and they’re willing to work with merchants and trusted providers to make this possible.

There’s an increased understanding within financial institutions that greater communication and trust between all the players within the payments ecosystem leads to better results for everyone involved. Greater trust enables higher conversions, benefiting merchants and banks and dramatically improving the online experience for customers.

To find out more about approaches that merchants are taking to improve their communication with banks, and the impact that can have on their bottom line, take a look at this white paper: Payment Optimization: Surfacing Simple Decisions to Unlock Millions in Revenue & Improve Customer Experience.