Visa is updating its requirements for submitting compelling evidence in April 2023. Here’s what the changes mean for your business.

The pandemic accelerated the consumer shift to digital commerce — quickly overwhelming financial institutions and merchants as digital commerce fraud spiked. In particular, merchants experienced increased first-party fraud, also called friendly fraud. In 2021, friendly fraud ranked second among the types of fraud causing the most losses to digital commerce merchants in the United States, accounting for 29% of losses.

Friendly fraud is when a cardholder tells their issuer that a legitimate purchase on their transaction statement is fraudulent and disputes it via the chargeback process. This can occur if cardholders accidentally believe a legitimate charge is fraud, for example, if they do not recognize the billing descriptor or forgot about the purchase. Friendly fraud can also be committed intentionally due to buyer’s remorse or abuse. Regardless of the intention, these transactions are considered by both card brands and merchants to be legitimate and authorized.

Visa is releasing compelling evidence 3.0 (CE3.0) requirements to give merchants more leverage when fighting friendly fraud in a card-absent environment.

What is included in CE3.0?

In CE3.0, merchants can submit additional compelling evidence to better support their claim that the cardholder participated in the transaction. According to Visa’s guidelines, compelling evidence is “proof the cardholder participated in the transaction, received the goods or services, or benefitted from the transaction.”

It is important to note that CE3.0 updates are limited only to Visa disputes that are categorized as 10.4 Other Fraud – Card Absent Environment. For these disputes, Visa now offers merchants the ability to submit additional compelling evidence to establish the cardholder’s history of prior, legitimate transactions.

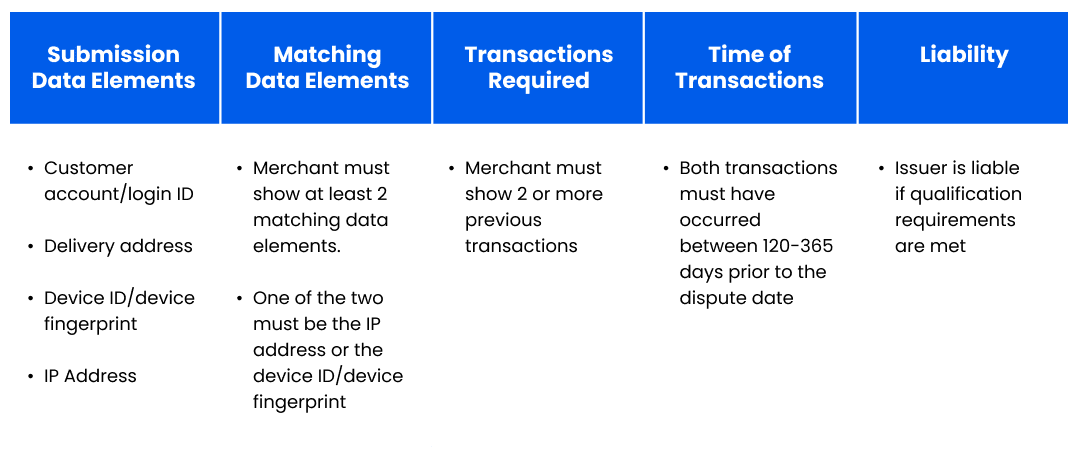

To take advantage of this new update, merchants must submit the following qualifications:

- Historical Footprint: At least two transactions that fall within 120-365 days of the dispute date are on the same payment method. It’s important to note that transactions previously disputed as fraud cannot count toward the transaction minimum.

- Data Validation: At least two core data elements are consistent across the different transactions. The core data elements include user ID, IP address, shipping address, and device ID. When submitting this information, at least one of the core data elements must be an IP address or device ID.

- Recurring Merchant Initiated Transactions (MIT), which are frequently used with subscription services, do qualify for CE3.0.

With this additional evidence, merchants can make a stronger case that the cardholder did indeed participate in the transaction and this transaction should not be considered fraudulent. If this case is made successfully, the merchant can shift the chargeback liability to the customer.

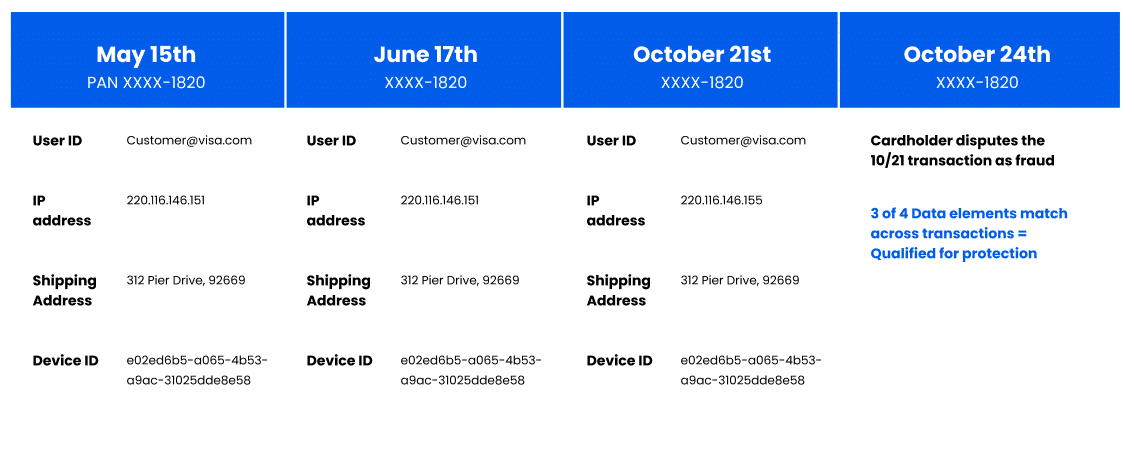

In the above example, the cardholder disputed the charge that occurred on October 21st due to fraud. However, the merchant was able to show that the cardholder had made two previous transactions in the past 120-365 days. In addition, they are able to show that 3 of the 4 data elements — user ID, shipping address, and device ID – match across the qualifications. As a result, this transaction is qualified for protection under CE3.0.

When can Merchants provide compelling evidence?

Merchants can submit the transaction data elements either pre-dispute or post-dispute:

- Pre-dispute: Merchants can submit the transaction data elements to issuers before the transaction in question becomes a chargeback. This is facilitated through Verifi’s Order Insight solution.

- Post-dispute: Merchants can submit the transaction data elements after the chargeback to regain revenue lost to illegitimate fraud disputes. This is facilitated via the merchant’s chargeback processor portal as part of the existing chargeback representment process.

What is the benefit of CE3.0?

CE3.0 will allow merchants to reduce the impact of friendly fraud on their fraud chargebacks.

Merchants who meet the qualifications for the transactions will benefit from the following:

- Retaining the revenue from the transaction

- Shifting the liability for the transaction to the issuer

- Deflecting the dispute with no impact on fraud ratio (in pre-dispute, it will not impact dispute or fraud ratio, and post-dispute, it will not impact fraud ratio)

The CE3.0 updates will be the most beneficial to merchants with business models that can easily establish the historical footprint and data validation. Since CE3.0 does apply to Merchant Initiated Transactions (MIT), subscription-based services and other businesses with high-frequency purchases stand to gain the most from these updates.

How to take advantage of CE3.0?

Leverage a single vendor for both Fraud Management and Chargeback Recovery

By partnering with a vendor that offers both a robust fraud management and chargeback recovery solution, merchants can consolidate the process to collect and share the required data elements with the acquirer, who will then pass on the information to Visa. The Fraud Management solution can collect the required data elements (e.g., IP address, account ID, etc.) — immediately at checkout. If a cardholder files a dispute in the future, the Chargeback Recovery solution can automatically aggregate the evidence and send it directly to the acquirer (and thus Visa).

Minimize the fraudulent transactions before they become chargebacks

By using an identity-based fraud prevention solution at checkout, merchants can minimize fraud from the get-go to significantly reduce chargebacks. By understanding the ‘who’ behind a transaction, an identity-based tool can find patterns across a consortium to decline fraudulent attempts that would lead to chargebacks.

Maximize your Revenue with a Modern Fraud and Chargeback Solution

We expect other card companies to follow Visa’s lead to help merchants recover revenue due to friendly fraud. Therefore, you need a modern solution that combines Fraud Management with Chargeback Recovery to automatically collect the required data elements and share them with the credit card companies to recover lost revenue.

Total chargeback costs are expected to surpass $117 billion in 2023, with $79 billion of those losses coming at the hands of merchants. Luckily, with Forter, you can avoid both friendly and criminal chargebacks, meaning a significant cost reduction and increased revenue for your business.

“We reduced chargebacks by 90%, avoided $250K in Visa penalties, and generated a 1,100% ROI in just the first six months working with Forter.” – Sean Condon, VP Omnichannel, ASICS

Learn more about our Fraud Management and Chargeback Recovery solutions.