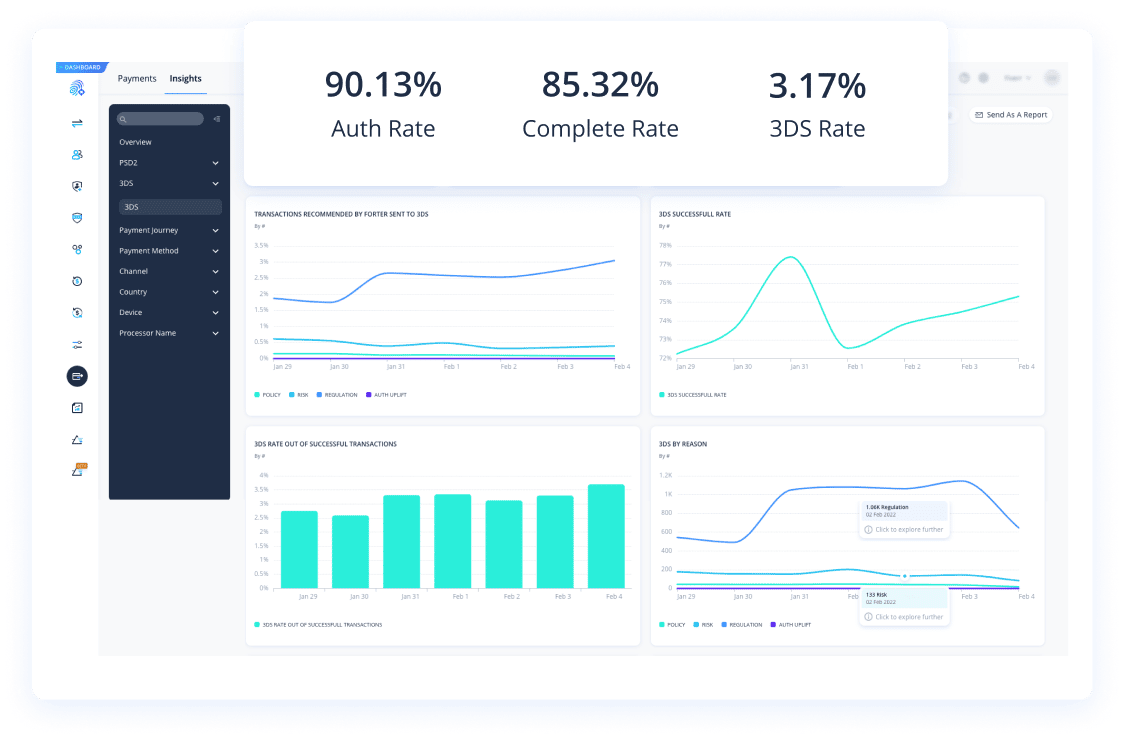

Smart 3DS

Intelligently apply 3DS to maximize conversions and minimize friction

Approve borderline risky transactions to drive conversions and shift chargeback liability while maximizing authorization rates

Optimize your payment flow with Smart 3DS

Approve borderline risky transactions

Forter’s Smart 3DS is the only product on the market that can leverage intelligent decisioning to help you approve more borderline transactions that would have otherwise been declined, thus increasing your conversions and revenue.

Shift chargeback liability

Our Smart 3DS feature makes intelligent decisions about when to route transactions through a frictionless 3DS experience so you can benefit from a significant chargeback liability shift while maximizing authorization rates.

Minimize friction to reduce 3DS cart abandonment

Depending on merchant preferences, our Smart 3DS will make intelligent decisions to send through 3DS authentication only when necessary or when there will be a completely frictionless experience, helping to maintain an optimal customer experience and drive both 3DS authentication rates and bank authorization rates up.

Optimize conversions and maintain compliance under PSD2 regulation

Our PSD2 optimization feature minimizes friction by maximizing exemptions and frictionless 3DS, providing a better customer experience while maximizing conversions.

The world’s leading brands trust Forter

Leverage Smart 3DS in multiple ways to meet the unique needs of your business

3DS authentication on borderline transactions

Forter’s 3DS technology is uniquely capable of identifying which transactions are considered borderline risky (and would have otherwise been declined) and routes them through 3DS to increase risk approval rate.

Frictionless 3DS

Our Frictionless 3DS feature makes intelligent decisions about which transactions should be routed through 3DS with a completely friction-free experience while also taking issuer preference into consideration. Avoid routing transactions to 3DS that are likely to result in the bank declining the authorization. This enables merchants to benefit from a chargeback liability shift while maintaining a pristine customer experience and maximizing authorization rates.

3DS Execution

With Forter agnostic 3DS execution feature, we ensure that all relevant data points will be shared with the issuer during the 3DS process, resulting in more frictionless transactions and higher authorization rates. In addition, Forter is able to use the 3DS protocol to share data with card schemes and issuers to increase authorization rates, even in cases where liability cannot be shifted. As the product is agnostic, merchants can process the transaction with any PSP.

PSD2 Optimization

Our PSD2 Optimization Solution applies smart decisioning as to when and how a 3DS challenge can be avoided. We maximize conversion by making intelligent routing decisions, sending transactions to 3DS authentication only when needed to create trust. We maximize exemptions and frictionless 3DS usage, maximizing authorization rates and increasing bottom-line revenue.