Fraud Management

Block fraud, not customers

Reduce chargebacks and false declines by up to 90% and deliver a superior customer experience

Maximize revenue, approve more customers, and accelerate growth with instant fraud decisions

Approve more with confidence

Merchants can lose up to 75x more revenue to false declines than to fraud, so ensuring your fraud solution doesn’t over-rotate on fraud prevention and delivers the highest approval rate is more critical than ever.

The Forter Decision Engine, powered by 1.2B+ identities in our cross-merchant dataset, makes instant assessments of trust at checkout. Our technology uses the speed of AI to make decisions, the sophistication of machine learning to detect patterns across vast datasets, and the savvy of fraud experts to continuously update our models. Eliminate false declines and allow more good buyers in while keeping fraud out.

Eliminate fraud costs

Don’t let fraud impact your bottom line. Forter accurately identifies and blocks known and new fraudsters with similar patterns, ensuring you significantly reduce chargebacks and protect your revenue. You can further reduce chargeback costs by leveraging Smart 3DS to shift chargeback liability to the issuing banks.

Unlock seamless scalability

The Forter Decision Engine enables us to deliver accurate, real-time decisions for known and unknown forms of fraud in real-time so merchants can scale seamlessly to meet any burst in demand and accommodate growth without additional resources. Enter new markets, accept new payment methods, and support omnichannel experiences without increasing fraud.

The world’s leading brands trust Forter

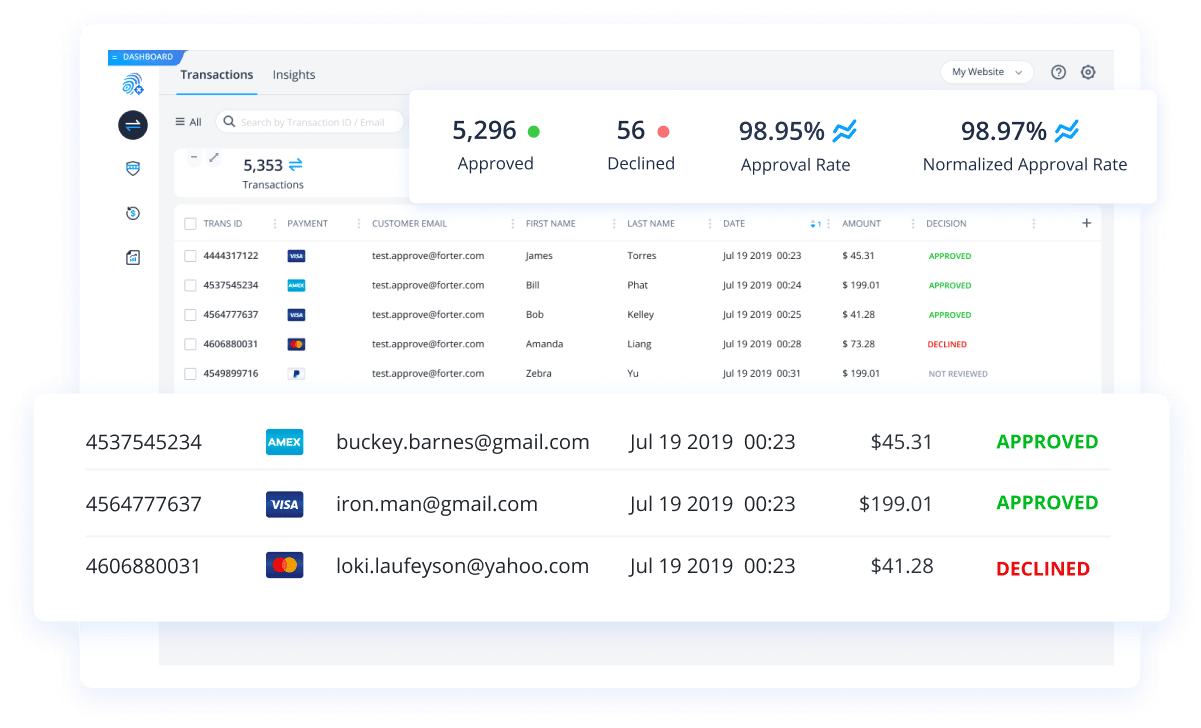

Make precise decisions about customer trustworthiness

Block Bad Actors with Confidence

Reduce loss and chargebacks by making precise decisions about customer trustworthiness at checkout so you can stop fraudsters in their tracks. Learn more about how you can leverage 3DS to shift chargeback liability with our Payment Optimization solution.

Eliminate False Declines

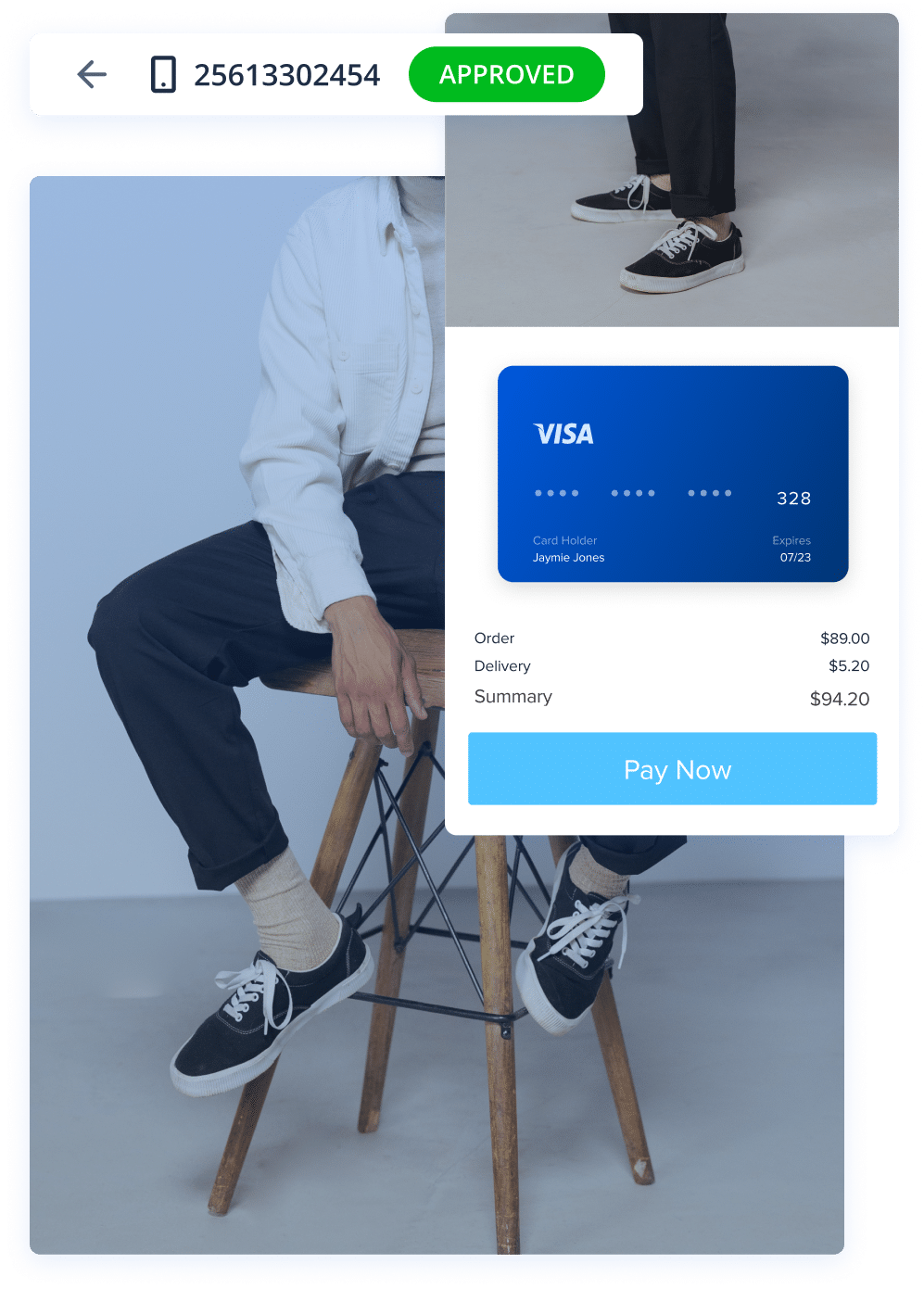

Assess trust instantly with decisions made in under a second so you can approve far more genuine transactions from good customers.

Support all payment methods

Instant approve/decline decisions on payment transactions, including credit, debit, and prepaid cards plus stored value payments, digital wallets, BNPL applications, bank redirects, bank transfers, and more.

Guaranteed performance

Guaranteed results regarding fraud chargebacks, approval rates, and response time SLAs.